DPI Private Equity Definition

In the realm of private equity, understanding the nuances of DPI is crucial. Discover its definition and embark on a journey to unravel its significance and discover the secrets behind maximizing your investment potential.

Understanding the Challenges

When it comes to private equity, navigating the complexities can be daunting. DPI, a fundamental metric, poses challenges for investors seeking clarity and optimal returns. Its intricate nature often leaves professionals grappling with questions and uncertainties, hindering their ability to make informed decisions.

Defining DPI Private Equity Definition

DPI, or Distributions to Paid-In Capital, measures the cash distributions an investor receives from a private equity fund relative to the amount of capital they initially invested. It serves as a key indicator of the fund’s performance and the investor’s return on investment.

Demystifying DPI Private Equity Definition

How Private Equity Investments Works – Stumpblog – Source stumpblog.com

DPI Private Equity Definition quantifies the cash distributions made to investors in proportion to their initial capital contribution. This metric provides insights into the fund’s ability to generate returns and distribute cash flow to investors. Understanding DPI empowers investors to assess the fund’s financial performance and make informed decisions about their investments.

History and Myths of DPI Private Equity Definition

EQUITY BANK COMPLETES THE ACQUISITION OF CERTAIN ASSETS AND LIABILITIES – Source equitygroupholdings.com

The concept of DPI has evolved over time, with varying interpretations and misconceptions. Historically, DPI was solely associated with the final distribution at the end of a fund’s life. However, modern private equity practices recognize DPI as an ongoing measure that reflects the fund’s performance throughout its investment cycle.

Uncovering the Secrets of DPI Private Equity Definition

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

9 Explain the Difference Between Private Equity and Hedge Funds – Source brodydesnhnewman.blogspot.com

Unveiling the secrets of DPI Private Equity Definition requires a comprehensive understanding of the factors that influence it. Fund structure, investment strategy, portfolio company performance, and market conditions all play a role in shaping DPI. By considering these variables, investors can gain a deeper appreciation of DPI and make more informed investment decisions.

Recommendations for Optimizing DPI Private Equity Definition

Fortnite 4K Ultra HD Wallpaper – Download Now! – Source wall.alphacoders.com

Maximizing DPI Private Equity Definition requires a strategic approach. Investors should conduct thorough due diligence on potential funds, evaluating their investment strategy, track record, and team. Diversifying investments across multiple funds can mitigate risks and enhance the overall return on investment.

DPI Private Equity Definition in Practice

Case studies and real-world examples illustrate the practical applications of DPI Private Equity Definition. Analyzing successful funds and their DPI performance can provide valuable lessons for investors seeking to optimize their own returns.

Tips for Enhancing DPI Private Equity Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Définition du capital-investissement – Source www.investirsorcier.com

Mastering DPI Private Equity Definition involves employing effective tips and strategies. Regularly tracking DPI distributions, understanding fund waterfall provisions, and considering tax implications can empower investors to make informed decisions and improve their overall investment experience.

DPI Private Equity Definition and Its Impact

The impact of DPI Private Equity Definition extends beyond mere financial returns. It influences the decision-making process of investors, shaping the allocation of capital and fostering the growth of the private equity industry.

Fun Facts about DPI Private Equity Definition

Officefitout5 – OfficeFITOUT.com.ng – Source officefitout.com.ng

Exploring the world of DPI Private Equity Definition unveils fascinating fun facts. From exceptionally high DPI distributions to record-breaking fund performances, these anecdotes offer a glimpse into the extraordinary achievements of the private equity landscape.

Mastering DPI Private Equity Definition

Cyno HD Adventure – Source wall.alphacoders.com

DPI Private Equity Definition is a sophisticated concept that requires a thorough understanding and practical implementation. Investors who embrace its intricacies and navigate its complexities are well-positioned to maximize their returns and achieve their financial goals.

What if DPI Private Equity Definition is Negative?

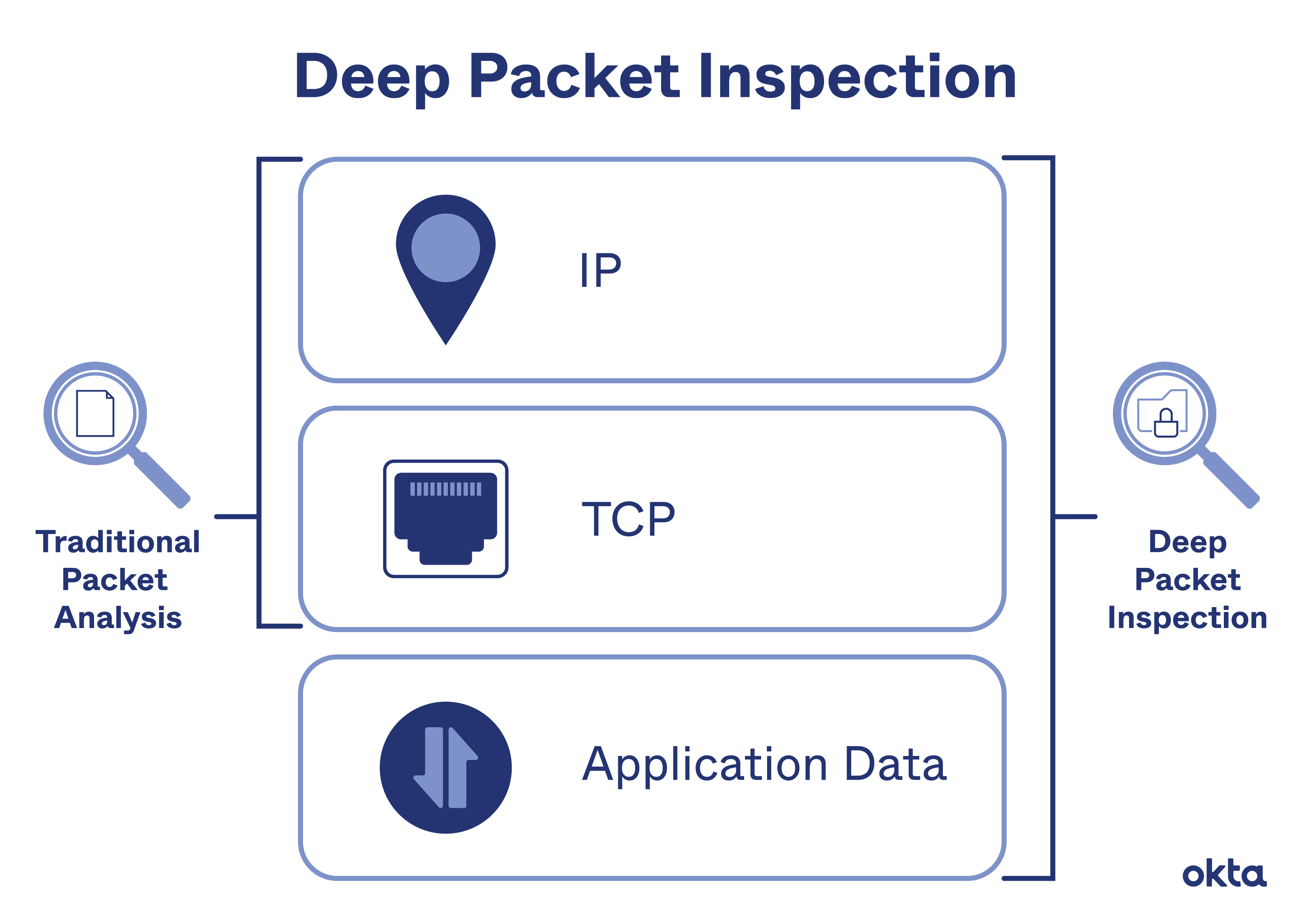

What Is Deep Packet Inspection (DPI)? Definition & Usage | Okta – Source www.okta.com

In certain circumstances, DPI Private Equity Definition may result in a negative value. This occurs when the cash distributions received by investors are insufficient to cover their initial investment. Understanding the reasons behind a negative DPI can provide valuable insights for investors seeking to avoid such situations.

Listicle: Key Points about DPI Private Equity Definition

Comprendre la véritable performance des fonds d’investissement grâce au – Source private-equity.fr

To enhance clarity and comprehension, consider this listicle summarizing the key points about DPI Private Equity Definition:

– DPI measures cash distributions to investors relative to their initial capital investment.

– It reflects the fund’s performance and investor returns.

– DPI is influenced by fund structure, investment strategy, and market conditions.

– Investors should evaluate funds’ DPI performance and diversify investments to optimize returns.

– Monitoring DPI distributions and understanding fund waterfall provisions are crucial for effective decision-making.

Question and Answer

A: DPI is used to assess the performance of private equity funds and the return on investment for investors.

A: DPI is calculated by dividing the total cash distributions received by investors by the total capital they invested.

A: A good DPI is generally considered to be 1.0 or higher, indicating that investors have received back at least their initial investment.

A: Factors that can affect DPI include the fund’s investment strategy, the performance of the portfolio companies, and market conditions.

Conclusion of DPI Private Equity Definition

DPI Private Equity Definition stands as a pivotal metric in the realm of private equity, providing investors with essential insights into fund performance and return on investment. By grasping its intricacies and employing effective strategies, investors can optimize their DPI Private Equity Definition and achieve their financial objectives in this dynamic and rewarding asset class.