Bank Of America: Committed To Enhancing Financial Well-being And Empowering Communities

In today’s fast-paced financial landscape, achieving financial well-being is paramount. Bank of America, a leading financial institution, is committed to empowering individuals and communities by providing tailored financial solutions and fostering inclusive economic growth. Embark on a journey to discover how Bank of America is transforming financial empowerment.

Many individuals grapple with financial challenges, from managing debt to saving for the future. Financial literacy and access to affordable financial services are crucial to breaking down these barriers.

Bank of America’s mission is to enhance financial well-being by creating innovative products and services that cater to diverse financial needs. By promoting financial inclusion and empowering communities, Bank of America aims to create a positive impact on society.

Bank of America’s Commitment to Financial Well-being

Bank of America’s initiatives are centered around financial education, responsible lending, and community development. The bank’s financial education programs equip individuals with the knowledge and skills to manage their finances effectively. Through partnerships with non-profit organizations, Bank of America provides free financial counseling and educational resources to underprivileged communities.

Empowering communities | Knox City Council – Source haveyoursay.knox.vic.gov.au

Bank of America’s responsible lending practices ensure that individuals have access to affordable credit while mitigating financial risks. The bank offers a range of loan options tailored to different financial needs, including mortgages, auto loans, and small business loans.

Centenary Bank on Twitter: “We received the Most Admired Ugandan – Source twitter.com

Empowering Communities through Economic Growth

Bank of America recognizes the vital role that communities play in economic development. The bank supports local businesses and organizations through its Community Development Banking division, which provides loans and grants to underserved communities. These investments foster job creation, affordable housing, and community revitalization initiatives.

Empowering Athlete Well-being: Aspetar’s Vision Embodied in “Enhancing – Source www.albawaba.com

A Rich History of Financial Empowerment

Bank of America’s commitment to financial well-being spans over a century. The bank has played a pivotal role in supporting American families and businesses throughout economic downturns and periods of growth. Through its unwavering dedication to financial inclusion, Bank of America has helped millions of people achieve their financial goals.

Dr Muhumuza: Financial Inclusion Hinged on General Economic Empowerment – Source chimpreports.com

The Secret to Financial Success

Bank of America believes that financial success is not a destination but a journey. The bank offers personalized guidance and support to help individuals and communities navigate their unique financial paths. By leveraging its expertise and resources, Bank of America empowers people to make informed financial decisions and build a secure financial future.

Midland’s Chemical Bank committed to expanding its Michigan footprint – Source www.mlive.com

Financial Literacy for All

Financial literacy is the foundation of financial well-being. Bank of America’s financial education initiatives provide individuals with the tools and knowledge they need to make informed financial choices. Through hands-on workshops, online resources, and community outreach programs, the bank empowers people to understand their finances, manage debt, and plan for the future.

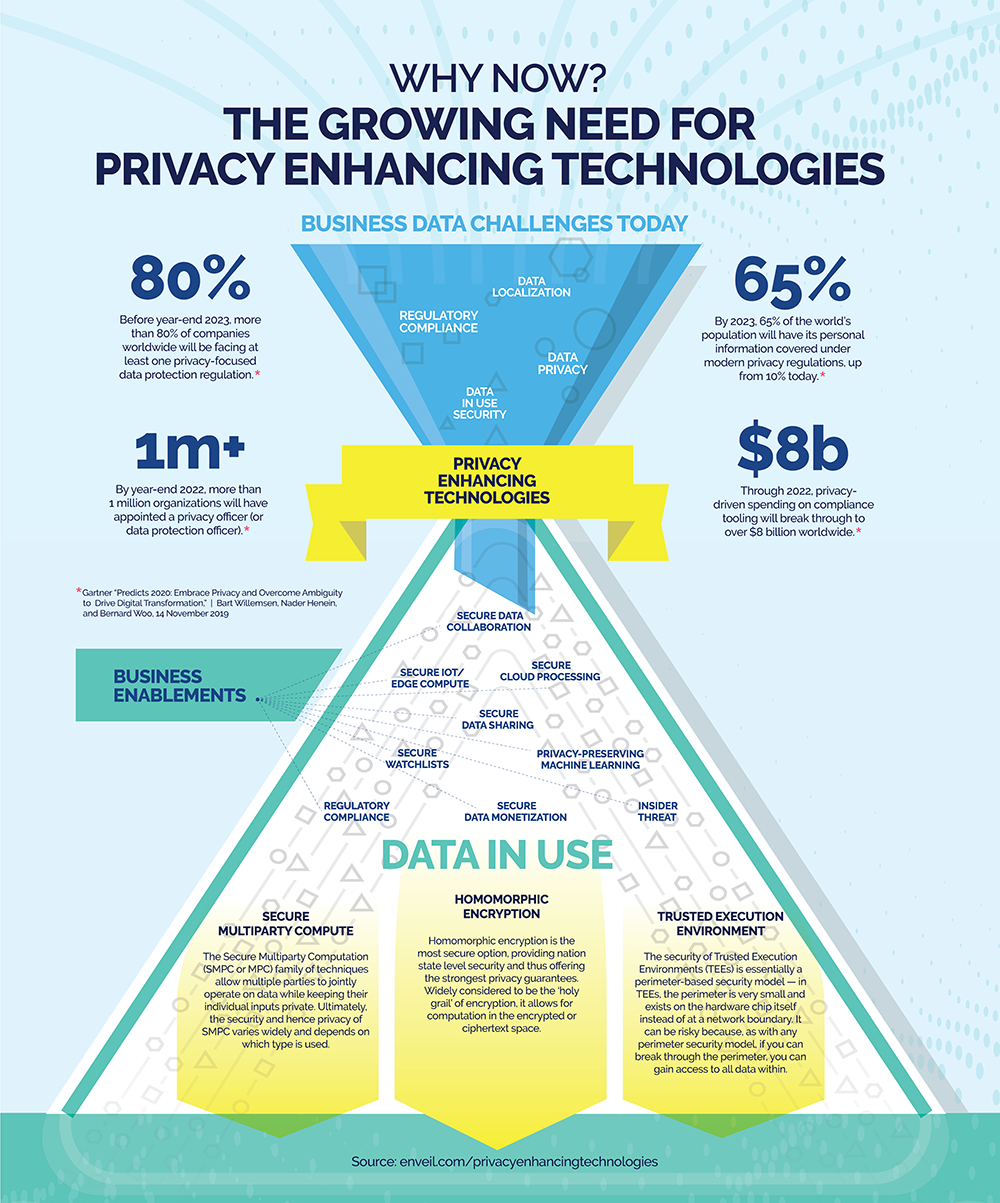

Unlocking the Transformative Power of Privacy Enhancing Technologies – Source www.datanami.com

Tips for Enhancing Financial Well-being

Achieving financial well-being requires a holistic approach. Bank of America offers practical tips and strategies to help individuals improve their financial situation:

Empowering Communities | Summit Health Cares – Source www.sh-cares.org

- Create a budget and track your expenses.

- Reduce unnecessary spending and save regularly.

- Explore different investment options to grow your wealth.

- Seek professional financial advice when needed.

Understanding Credit and Debt

Managing credit and debt is essential for financial well-being. Bank of America provides resources and guidance to help individuals understand credit scores, manage debt effectively, and avoid financial pitfalls.

Fun Facts about Bank of America

Did you know that Bank of America is the second-largest bank in the United States by assets? The bank’s headquarters is located in Charlotte, North Carolina. Bank of America is also a global financial institution with operations in over 30 countries.

How Mobile Technology Benefits the Banking & Finance Industry? – Latest – Source latestbulletins.com

How to Get Started with Bank of America

Opening an account with Bank of America is simple and convenient. You can apply online, visit a local branch, or call the bank’s customer service number. The bank offers a range of account options, including checking accounts, savings accounts, and investment accounts.

Tributes for Cheslie Kryst after TV star and former Miss America dies – Source wikinbiography.com

What If You Need More Help?

If you’re struggling with your finances, don’t hesitate to seek professional help. Bank of America offers a variety of financial assistance programs, including debt counseling, foreclosure prevention, and financial planning.

Empowering Students Starts with Empowering Teachers | RTI – Source www.rti.org

A List of Bank of America’s Services

Bank of America provides a wide range of financial services, including:

- Personal banking

- Business banking

- Investment services

- Mortgage lending

- Auto loans

- Credit cards

Question and Answer

Q: What is Bank of America’s commitment to financial well-being?

A: Bank of America is committed to enhancing financial well-being and empowering communities by providing tailored financial solutions and fostering inclusive economic growth.

Q: How does Bank of America promote financial inclusion?

A: Bank of America offers a range of financial education programs, responsible lending practices, and community development initiatives to promote financial inclusion and empower underprivileged communities.

Q: What are some tips for improving financial well-being?

A: Create a budget, track expenses, reduce spending, save regularly, explore investment options, and seek professional financial advice when needed.

Q: How can I get started with Bank of America?

A: You can apply for an account online, visit a local branch, or call the bank’s customer service number.

Conclusion of Bank of America: Committed to Enhancing Financial Well-being and Empowering Communities

Bank of America’s unwavering commitment to financial well-being and community empowerment has made a profound impact on millions of lives. Through its innovative financial solutions, educational initiatives, and community development programs, the bank is creating a more financially inclusive and prosperous society. As Bank of America continues to evolve, its mission to enhance financial well-being will remain a cornerstone of its operations, ensuring that individuals and communities thrive financially for generations to come.

/alice-wonderland-inside-ALICE0921-2000-b3c128f38d5243f6a7f329407956a724.jpg)