Private Equity Investment Returns Unmasked: DPI Calculations For Value Creation

Private Equity Investment Returns Unmasked: DPI Calculations For Value Creation

In the realm of investing, there’s often a shadow cast over the returns generated by private equity investments. A persistent question lingers: just how much value do these investments truly create? To shed light on this enigma, we venture into the world of DPI calculations—a crucial metric that unveils the hidden mechanisms behind private equity’s value generation.

Waterland Private Equity: Unternehmenskultur | LinkedIn – Source ch.linkedin.com

Clearing the Mist: Understanding Private Equity Investment Returns Unmasked: DPI Calculations For Value Creation

Private equity firms navigate a complex investment landscape, aiming to maximize returns for their investors. However, gauging the success of these investments often involves more than meets the eye. DPI calculations offer a precise and comprehensive assessment of the value created by these firms, going beyond surface-level metrics.

DPI: The Guiding Light in Value Creation

DPI, or Distribution to Paid-In Capital, emerges as an indispensable measure in the private equity realm. It reflects the total amount of cash an investor receives from an investment, divided by the amount of capital they initially invested. By scrutinizing DPI calculations, investors can determine whether a private equity fund has generated superior returns compared to other asset classes.

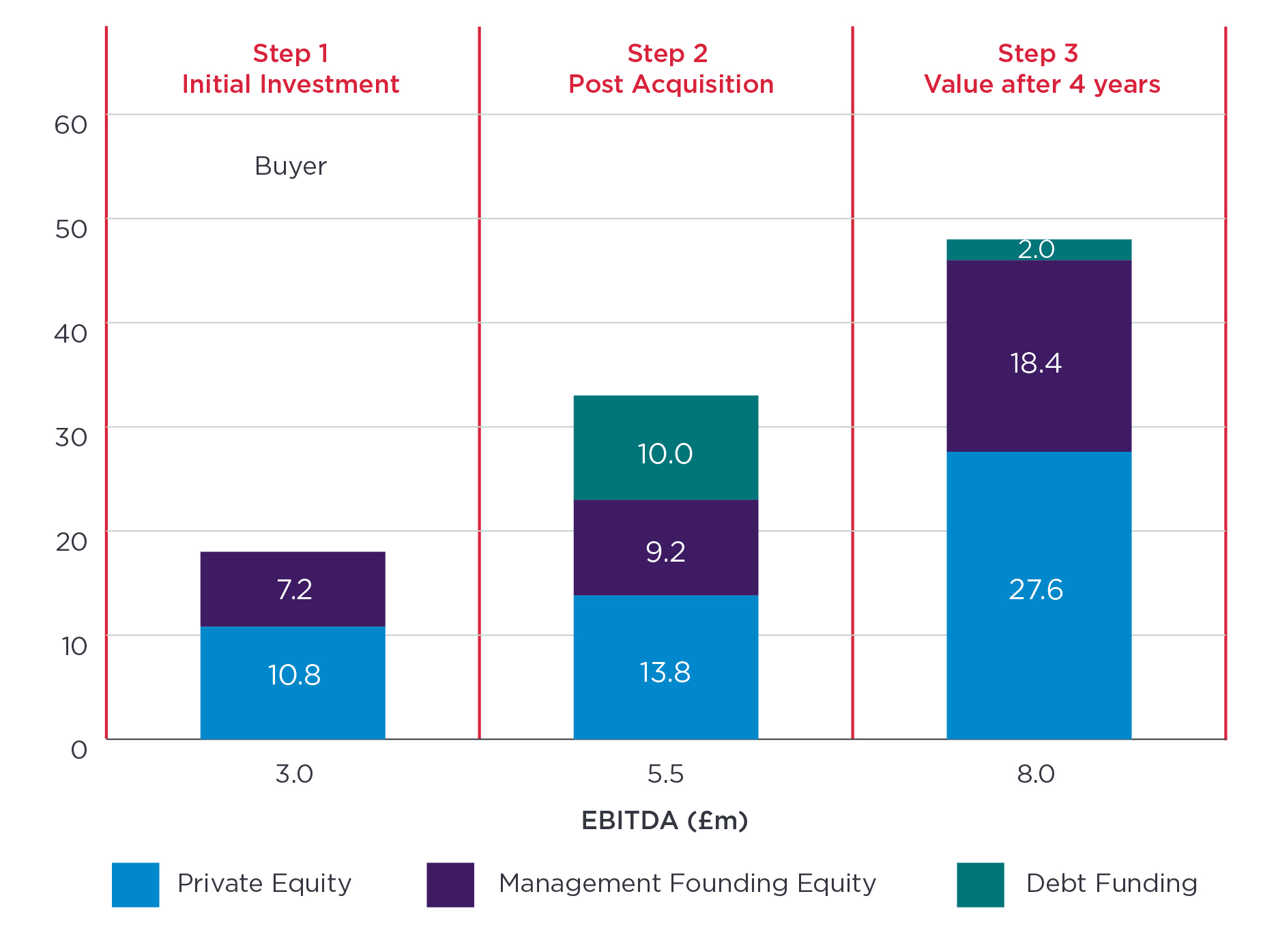

Value creation from exiting a private equity transaction | Johnston – Source johnstoncarmichael.com

Unveiling the Private Equity Enigma

DPI Calculations: Unveiling the Path to Value Creation

DPI calculations serve as a robust tool to assess a private equity investment’s performance. By analyzing the DPI data of various funds over multiple vintages, investors can identify patterns and trends in value creation. This information empowers them to make informed decisions about future investments and fosters transparency in the private equity market.

Private Equity’s Historical Legacy: Unraveling the Myths

The narrative surrounding private equity returns has often been tainted by myths and misconceptions. By examining historical DPI data, we can expose these myths and gain a clear understanding of the true value creation potential of private equity investments. A comprehensive analysis of DPI data can reveal the extent to which private equity firms have delivered on their promises.

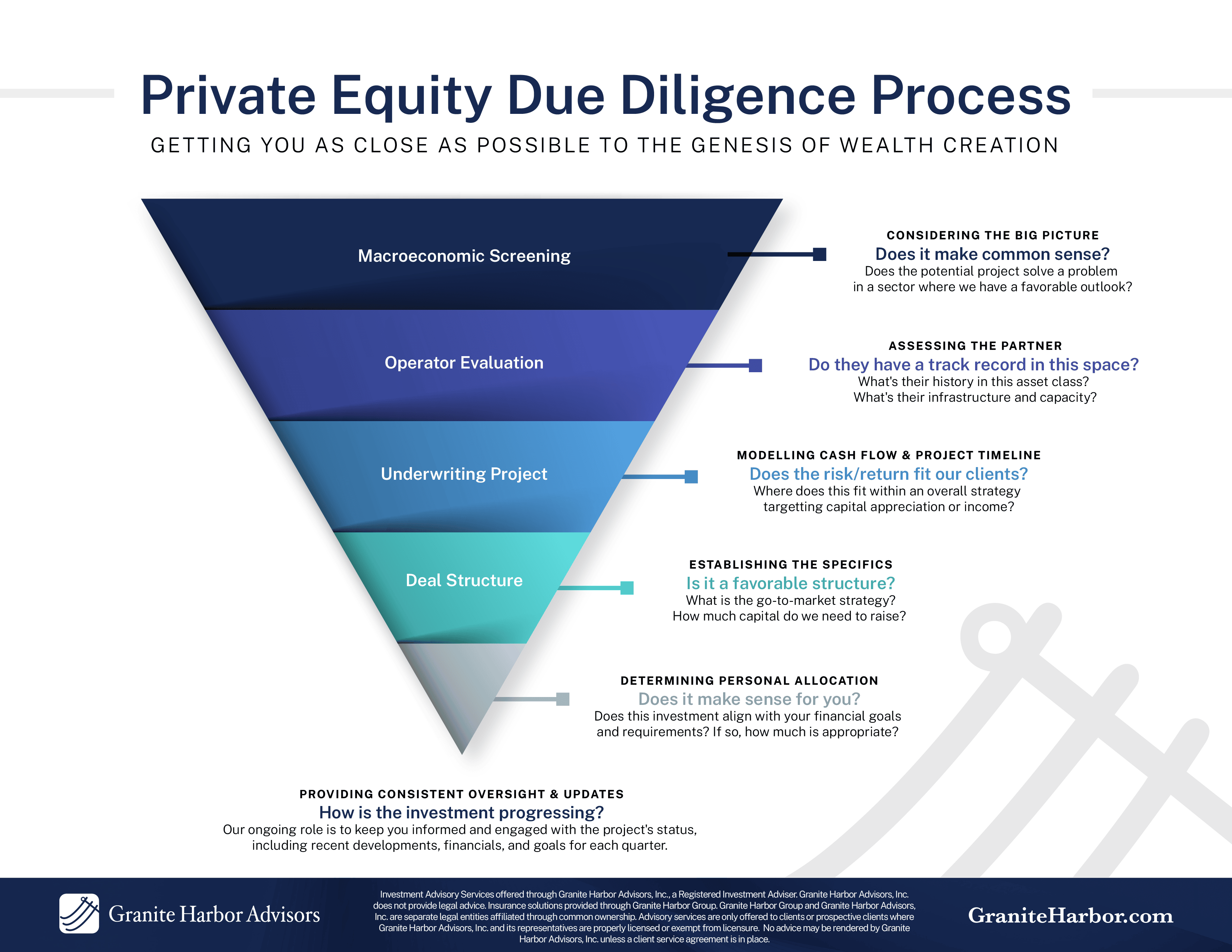

A Comprehensive Guide to the Private Equity Due Diligence Process – Source graniteharbor.com

Unveiling the Private Equity Secret Formula

DPI calculations serve as a window into the inner workings of private equity firms, uncovering their value creation strategies. By studying DPI data, investors can uncover the factors that contribute to strong performance, such as industry focus, investment style, and operational expertise.

Advising the Wise: Recommendations for Private Equity Investors

Armed with the insights gleaned from DPI calculations, investors can make wiser decisions about their private equity investments. By setting realistic return expectations and diversifying their portfolios, investors can mitigate risks and maximize their chances of achieving their financial goals.

Private equity investment by monish on Dribbble – Source dribbble.com

DPI Decoded: A Comprehensive Dive into Value Creation

DPI calculations offer a granular view of value creation in private equity. By analyzing DPI data, investors can understand how private equity firms generate returns through capital appreciation, dividends, and other distributions. This knowledge empowers investors to evaluate the true performance of private equity funds and make informed investment decisions.

Tips for Effective Private Equity Investment

Harnessing the power of DPI calculations, investors can optimize their private equity investments. By seeking out funds with strong DPI track records, conducting thorough due diligence, and aligning their expectations with the fund’s strategy, investors can increase their chances of achieving success in the private equity market.

Private Equity – ALFWASL Project Management Services – Source alfwaslservices.com

DPI: The Cornerstone of Private Equity Value Creation

DPI calculations are not merely numbers; they represent the foundation of value creation in private equity. Investors who embrace the insights offered by DPI data can unlock the potential for superior returns and achieve their financial aspirations.

Mind-Boggling Facts about Private Equity Returns

Unveiling the mysteries of private equity returns through DPI calculations uncovers a treasure trove of fascinating facts. From the impact of fund size on performance to the importance of industry specialization, DPI data reveals the secrets behind private equity’s ability to generate wealth.

Mastering Private Equity Investment: A Step-by-Step Guide

Navigating the world of private equity investments with confidence requires a clear understanding of the process. This comprehensive guide empowers investors with the knowledge and strategies needed to identify and invest in top-performing private equity funds, maximizing their chances of achieving financial success.

#MyFirstMcJob — Kanika Goela, Private Equity Investment Professional at – Source medium.com

What if: Exploring Alternative Private Equity Investment Strategies

DPI calculations provide a roadmap for examining different private equity investment strategies and their potential impact on returns. By analyzing the DPI data of funds employing diverse strategies, investors can make informed decisions about their own investment approach and diversify their portfolios.

The Private Equity Toolkit: A Listicle of Essential Considerations

Empowering investors with a practical toolkit, DPI calculations facilitate informed decision-making in private equity investments. This listicle outlines key considerations, from understanding the fund’s investment thesis to evaluating the management team, empowering investors to navigate the complexities of the private equity market with confidence.

Sygnus Capital boss urges legislation for private equity development – Source sygnusgroup.com

Question and Answer: Unraveling Private Equity Investment Returns

- Q: How do DPI calculations differ from traditional performance metrics like IRR?

A: DPI calculations provide a more comprehensive view of an investment’s performance by considering all cash distributions received by investors, while IRR focuses solely on the internal rate of return.

- Q: Can DPI calculations be manipulated by private equity firms?

A: Yes, DPI calculations can be affected by the timing and structure of distributions, so it’s important to scrutinize the data carefully and consider other performance metrics.

- Q: What factors should investors consider when analyzing DPI data?

A: Investors should consider the fund’s vintage year, investment strategy, industry focus, and management team when evaluating DPI data.

- Q: How can investors use DPI calculations to maximize their private equity investments?

A: By understanding DPI calculations and the factors that influence them, investors can make informed decisions about which funds to invest in and how to allocate their capital.

Conclusion of Private Equity Investment Returns Unmasked: DPI Calculations For Value Creation

Private equity investments offer the potential for superior returns, but unlocking the true value of these investments requires a deep dive into DPI calculations. By embracing the power of DPI data, investors can decipher the complexities of private equity, make informed decisions, and maximize their chances of achieving their financial goals.