Understanding The Differences And Similarities Between ASC 606 And ASC 605

Navigating the complexities of financial reporting can be daunting. Two significant accounting standards, ASC 606 and ASC 605, have emerged, leaving many businesses grappling with their implications.

Understanding the nuances between ASC 606 and ASC 605 is essential for businesses to accurately represent their financial performance. ASC 606, Revenue from Contracts with Customers, provides guidance on recognizing revenue from contracts with customers, while ASC 605, Not-for-Profit Entities, focuses on the specific requirements for not-for-profit organizations.

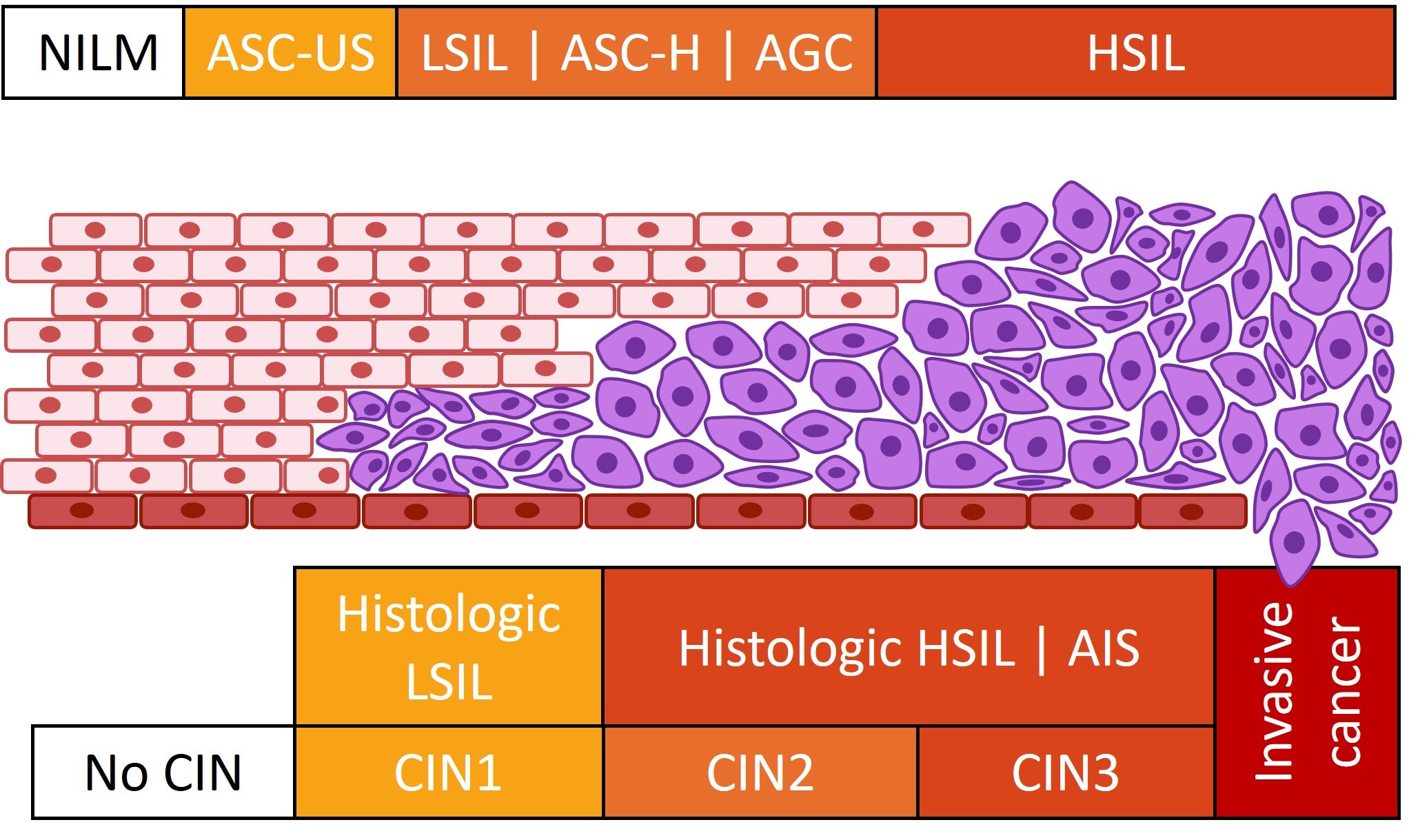

Cervical Cancer Screening – teachIM – Source teachim.org

Understanding ASC 606 and ASC 605: Target and Scope

To effectively implement ASC 606 and ASC 605, businesses must first understand their target audience and scope. ASC 606 applies to all entities that enter into contracts with customers. This includes both for-profit and not-for-profit organizations.

ASC 606 vs IFRS 15: What is the difference? | Trullion – Source trullion.com

ASC 606 and ASC 605: A Closer Look

While both ASC 606 and ASC 605 provide guidance on financial reporting, they differ in their specific requirements. ASC 606 emphasizes the five-step revenue recognition model, ensuring that revenue is recognized when it is earned. ASC 605, on the other hand, provides a comprehensive framework for not-for-profit entities, addressing unique aspects such as contributions and grants.

ASC 606 Explained: Understanding Revenue Recognition – Little Book for – Source littlebookforbrides.com

ASC 606 and ASC 605: History and Evolution

To fully grasp the significance of ASC 606 and ASC 605, it is essential to explore their history. ASC 606 evolved from various previous revenue recognition standards, culminating in a cohesive framework. Similarly, ASC 605 emerged from the need to address the specific challenges faced by not-for-profit organizations.

ASC Billing & Hospital Outpatient Billing – Understanding the – Source issuu.com

ASC 606 and ASC 605: Hidden Benefits

Beyond their primary objectives, ASC 606 and ASC 605 offer hidden benefits. ASC 606 enhances transparency and comparability in financial reporting, while ASC 605 strengthens the accountability and governance of not-for-profit organizations.

ASC 606 Compliance: Choosing a Commission Expensing Solution | Spiff – Source spiff.com

ASC 606 and ASC 605: Recommendations for Implementation

Proper implementation of ASC 606 and ASC 605 is crucial for businesses. To ensure a smooth transition, it is recommended to consult with accounting professionals, conduct thorough training, and proactively address potential challenges.

Histology of Alarm Substance Cells in Relation to Parasite Load and – Source slideplayer.com

ASC 606 and ASC 605: Considerations for Not-For-Profit Entities

Not-for-profit organizations face unique considerations when implementing ASC 605. They must carefully assess the impact on their financial statements, particularly in areas such as contributions and grants.

ASC 606 – The Time is Now | MorganFranklin Consulting – Source www.morganfranklin.com

ASC 606 and ASC 605: Key Differences

A key difference between ASC 606 and ASC 605 lies in their scope. While ASC 606 applies to all entities with customer contracts, ASC 605 focuses exclusively on not-for-profit organizations.

ASC 606 and its impact on SaaS Revenue Recognition – Source www.visdum.com

ASC 606 and ASC 605: Fun Facts

Navigating ASC 606 and ASC 605 can be challenging, but it also presents opportunities for innovation. By embracing the principles of these standards, businesses can enhance their financial reporting practices and gain a competitive advantage.

Differences Between ASC 606 And IFRS 15, 52% OFF – Source www.gbu-presnenskij.ru

ASC 606 and ASC 605: How It Works

Understanding how ASC 606 and ASC 605 operate is crucial for successful implementation. ASC 606 provides a step-by-step guide to revenue recognition, while ASC 605 offers specific guidance for not-for-profit entities.

Selecting Modified Retrospective Transition for Adopting ASC 606 and – Source www.cpajournal.com

ASC 606 and ASC 605: What If Scenarios

To fully prepare for potential challenges, it is essential to consider “what if” scenarios. Businesses should assess their readiness to address various situations that may arise during the implementation of ASC 606 and ASC 605.

ASC 606 and ASC 605: A Comprehensive List

To summarize the key aspects of ASC 606 and ASC 605, here is a listicle highlighting their core components, differences, and significance for various entities.

Question and Answer: Understanding ASC 606 and ASC 605

- Q: What is the primary objective of ASC 606?

A: To provide guidance on recognizing revenue from contracts with customers. - Q: What is the unique focus of ASC 605?

A: Not-for-profit entities, addressing specific aspects such as contributions and grants. - Q: What is a key difference between ASC 606 and ASC 605?

A: ASC 606 applies to all entities with customer contracts, while ASC 605 focuses on not-for-profit organizations. - Q: Why is understanding ASC 606 and ASC 605 important for businesses?

A: To ensure accurate financial reporting, improve transparency, and potentially gain a competitive advantage.

Conclusion of Understanding The Differences And Similarities Between ASC 606 And ASC 605

Understanding the differences and similarities between ASC 606 and ASC 605 empowers businesses to navigate the complexities of financial reporting. By embracing these standards, companies can enhance their accounting practices, strengthen their financial position, and confidently address future challenges.