Par Vs Non-Par: Examining The Differences In Equity And Liquidity

Par Vs Non-Par: Examining The Differences In Equity And Liquidity

The world of finance can be a complex and confusing place, especially when it comes to understanding the different types of investments available. Two common types of investments are par and non-par securities. But what exactly is the difference between the two? And which one is right for you? In this blog post, we’ll take a closer look at par and non-par securities and help you understand the key differences between them.

Standard Liege Home Maillot de foot 1998 – 1999. – Source www.oldfootballshirts.com

Par securities are those that are issued with a face value, or par value. This value is typically set by the issuer of the security and represents the amount of money that the investor will receive back when the security matures. Non-par securities, on the other hand, do not have a face value. Instead, their value is determined by the market, and it can fluctuate over time.

Lot de 5 tournevis isolés WURTH 061396325 VDE à coupe 2,5 4 6,5 à croix – Source www.amazon.fr

One of the key differences between par and non-par securities is the way that they are priced. Par securities are typically priced at or near their face value. This is because the issuer of the security is obligated to pay the face value back to the investor when the security matures. Non-par securities, on the other hand, can be priced at any value, and their price can fluctuate over time. This is because the issuer of the security is not obligated to pay the face value back to the investor when the security matures.

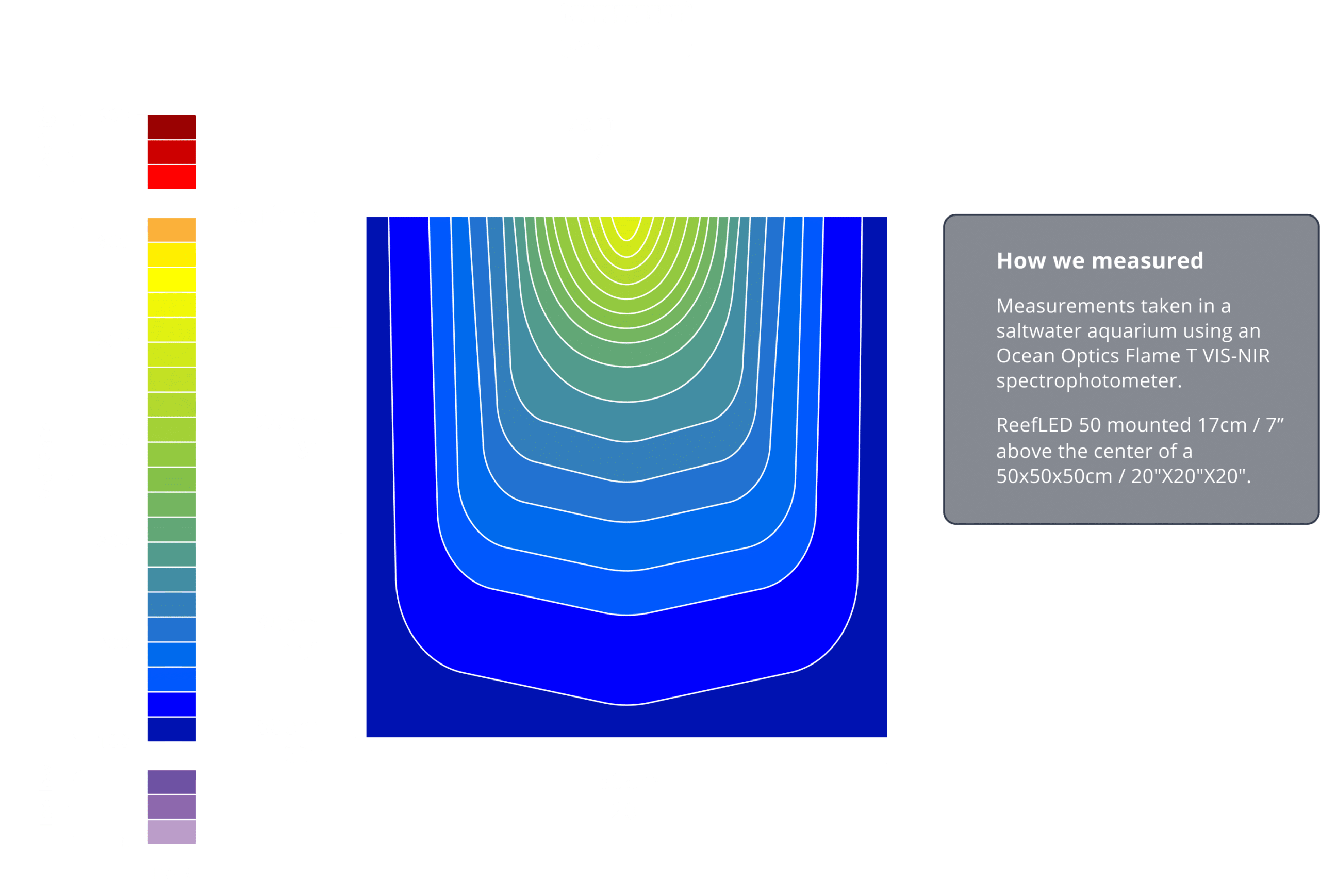

ReefLED 50 – smart, safe, efficient reef lighting – Fully utilized by – Source g1.redseafish.com

Another key difference between par and non-par securities is the way that they are taxed. Par securities are typically taxed at the same rate as other types of fixed-income investments, such as bonds. Non-par securities, on the other hand, are typically taxed at the same rate as stocks, which can be a higher rate.

Paraguay vs Bolivia: Copa America 2020| PAR vs BOL Live score Watch – Source diggingsports.in

So, which type of security is right for you? It really depends on your individual investment goals and risk tolerance. If you are looking for a safe and stable investment, then par securities may be a good option for you. However, if you are willing to take on more risk in exchange for the potential for higher returns, then non-par securities may be a better option for you.

Personal Experience with Par and Non-Par Securities

I have personally invested in both par and non-par securities over the years, and I have found that each type of security has its own advantages and disadvantages. Par securities have provided me with a steady stream of income, while non-par securities have the potential to generate higher returns. However, non-par securities also come with more risk.

One of the most important things to remember when investing in non-par securities is that their value can fluctuate over time. This means that you could lose money if you sell your non-par securities for less than you paid for them. However, if you are willing to hold onto non-par securities for the long term, then you have the potential to generate higher returns than you would with par securities.

History of Par and Non-Par Securities

Par and non-par securities have been around for centuries. The first par securities were issued in the early 1800s, and non-par securities were first issued in the late 1800s. Over the years, both types of securities have been used by investors to generate income and grow their wealth.

Hidden Secrets of Par and Non-Par Securities

There are a few hidden secrets about par and non-par securities that you should be aware of before investing in them. First, par securities are not always safe investments. If the issuer of the security defaults on its obligations, then you could lose your entire investment. Second, non-par securities can be very volatile, and their value can fluctuate significantly over time. Third, non-par securities are often more difficult to sell than par securities.

Recommendation for Par and Non-Par Securities

If you are considering investing in par or non-par securities, then it is important to do your research and understand the risks involved. You should also speak with a financial advisor to make sure that you are making the right investment decision for your individual needs.

Par Vs Non-Par: Examining The Differences In Equity And Liquidity

Tips for Investing in Par and Non-Par Securities

Here are a few tips for investing in par and non-par securities:

Par Vs Non-Par: Examining The Differences In Equity And Liquidity

Fun Facts about Par and Non-Par Securities

Here are a few fun facts about par and non-par securities:

How to Buy Par and Non-Par Securities

You can buy par and non-par securities through a broker or directly from the issuer of the security. If you are buying par and non-par securities through a broker, then you will need to pay a commission. If you are buying par and non-par securities directly from the issuer of the security, then you will not need to pay a commission.

What If You Sell Par and Non-Par Securities?

If you sell par and non-par securities, then you will need to pay capital gains tax on any profits that you make. The capital gains tax rate that you pay will depend on your income and the length of time that you held the par and non-par securities.

Listicle of Par and Non-Par Securities

Here is a listicle of par and non-par securities:

Question and Answer about Par and Non-Par Securities

Conclusion of Par Vs Non-Par: Examining The Differences In Equity And Liquidity

Par and non-par securities are two different types of investments that can be used to generate income and grow wealth. However, it is important to understand the key