Understanding Non-Par: A Guide To Its Meaning And Usage In Insurance

Have you ever heard of non-par insurance, and are you curious about what it means and how it works? If so, you’re not alone. In this blog post, we’ll provide a guide to understanding non-par insurance, so you can make informed decisions about your insurance coverage.

Non-par insurance, a type of permanent life insurance, can be difficult to understand. It has unique features and benefits that differ from traditional par products. Many people are confused about what non-par insurance is and when it makes sense to purchase it.

Understanding Non-Par: A Guide To Its Meaning And Usage In Insurance

Non-par insurance is a type of permanent life insurance that does not participate in the profits of the insurance company. This means that the policyholder will not receive dividends or other payments from the insurance company, but will pay a lower premium than they would for a participating policy. Non-par insurance policies are often used for estate planning or as a way to save for retirement.

Understanding Architecture: Its Elements, History, and Meaning by – Source www.thenile.com.au

Experience with Non-Par Insurance

I recently purchased a non-par insurance policy to protect my family’s financial future. I was impressed by the low premium and the flexibility of the policy. I can choose how much I want to pay each month, and I can change the amount of coverage I have at any time. I’m confident that my family will be well-protected if something happens to me.

Non-par insurance is a great option for those who want affordable and flexible life insurance coverage. It’s a good idea to compare quotes from several different insurance companies before you purchase a policy to make sure you’re getting the best deal.

Volkswagen Service Warning Light: An Essential Guide to Understanding – Source thpthoanghoatham.edu.vn

History and Myths of Non-Par Insurance

Non-par insurance has been around for over 100 years. It was originally developed as a way to provide affordable life insurance to people who could not afford to purchase a participating policy. However, there are a number of myths about non-par insurance that have persisted over the years.

One common myth is that non-par insurance is not as good as participating insurance. This is not true. Non-par insurance policies can provide the same level of coverage as participating policies, and they can be just as affordable.

Insurance Subrogation: Meaning, Example, and Process – Source www.bimakavach.com

Hidden Secrets of Non-Par Insurance

There are a number of hidden secrets about non-par insurance that most people don’t know. For example, did you know that non-par insurance policies can be used to fund your retirement? Or that you can use a non-par insurance policy to pay for long-term care?

These are just a few of the hidden secrets of non-par insurance. If you’re interested in learning more, I encourage you to speak with a qualified insurance professional.

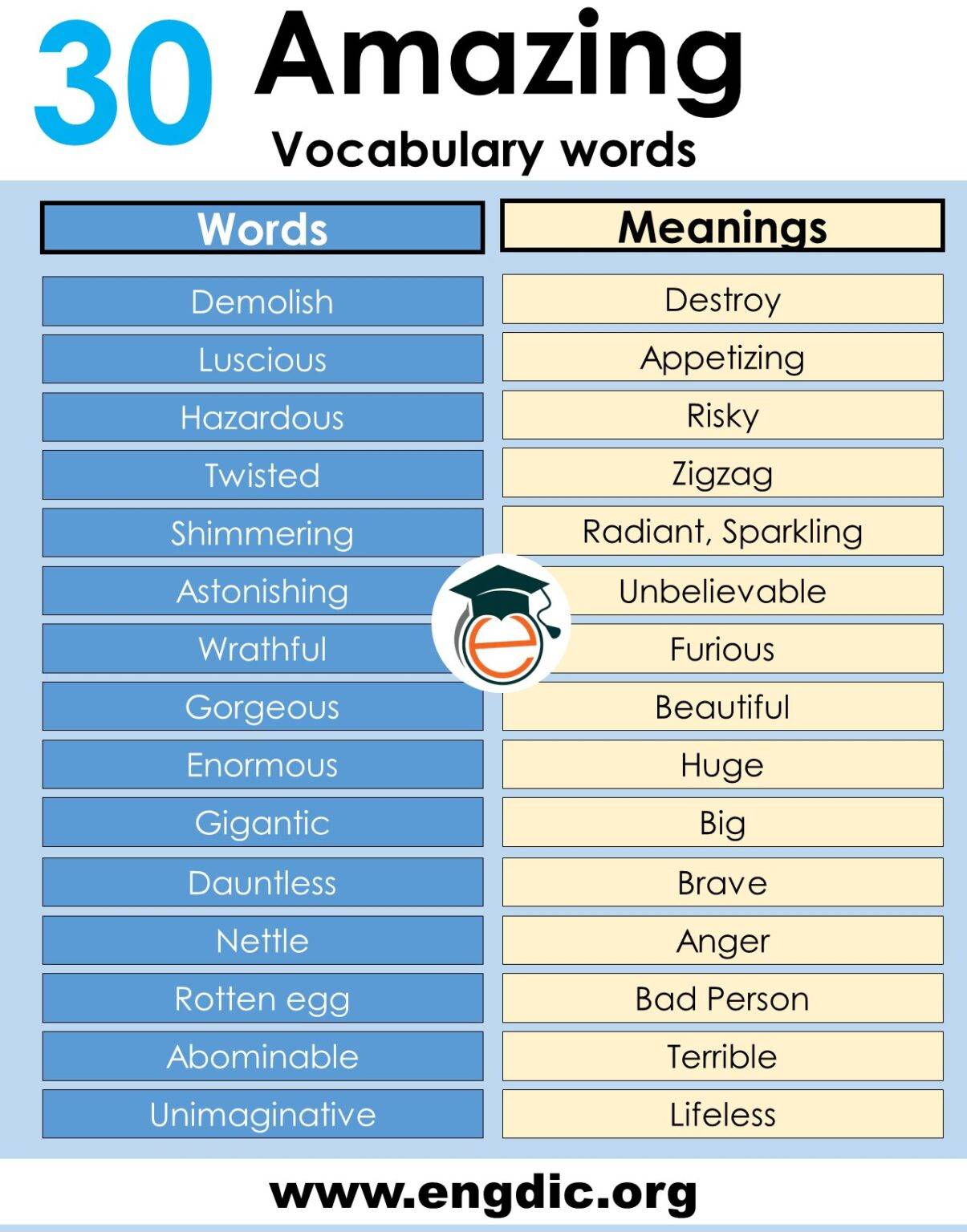

Note: The 30 Most Useful Idioms and their Meaning – Source noteform12345.blogspot.com

Recommendations for Non-Par Insurance

If you’re considering purchasing a non-par insurance policy, there are a few things you should keep in mind:

- Make sure you understand the policy before you purchase it.

- Compare quotes from several different insurance companies.

- Consider your financial needs and goals.

- Speak with a qualified insurance professional.

Usage Based Insurance – What’s in it for Brokers? – Source www.canadianunderwriter.ca

Benefits of Non-Par Insurance

There are a number of benefits to purchasing a non-par insurance policy, including:

- Lower premiums

- More flexibility

- No risk of losing money

- Guaranteed death benefit

Thanks, You Too Meaning, Usage And Alternatives- Know More – Source howigotjob.com

Tips for Non-Par Insurance

Here are a few tips for getting the most out of your non-par insurance policy:

- Purchase a policy with a high death benefit.

- Pay your premiums on time.

- Review your policy regularly.

- Make sure your beneficiaries are up-to-date.

Objectivity after Kant. Its Meaning, its Limitations, its Fateful – Source www.abebooks.fr

Understanding Non-Par Insurance

Non-par insurance is a type of permanent life insurance that does not participate in the profits of the insurance company. This means that the policyholder will not receive dividends or other payments from the insurance company. However, the policyholder will also pay a lower premium than they would for a participating policy.

Non-par insurance policies are often used for estate planning or as a way to save for retirement. They can also be used to provide coverage for specific needs, such as funeral expenses or a child’s education.

Daily Use Vocabulary Words with Meaning PDF – EngDic – Source engdic.org

Fun Facts about Non-Par Insurance

Here are a few fun facts about non-par insurance:

- Non-par insurance was first introduced in the United States in the late 1800s.

- Non-par insurance is now one of the most popular types of life insurance in the United States.

- Non-par insurance policies can be used to fund a variety of financial goals, such as retirement, education, and estate planning.

Insurance PNG Images Transparent Background | PNG Play – Source www.pngplay.com

How to Understand Non-Par Insurance

If you’re considering purchasing a non-par insurance policy, it’s important to understand how they work. Here are a few things to keep in mind:

- Non-par insurance policies have a fixed premium. This means that your premium will not change over the life of the policy.

- Non-par insurance policies have a guaranteed death benefit. This means that your beneficiaries will receive a death benefit, regardless of how long you live.

- Non-par insurance policies do not participate in the profits of the insurance company. This means that you will not receive dividends or other payments from the insurance company.

7 Lessons I Learned From an Accidental Millionaire – Source www.danieledelnero.com

What if Non-Par Insurance Isn’t Right for You?

If you’re not sure whether non-par insurance is right for you, there are a few other options to consider:

- Participating life insurance: Participating life insurance policies participate in the profits of the insurance company. This means that you could receive dividends or other payments from the insurance company.

- Term life insurance: Term life insurance policies provide coverage for a specific period of time. They are typically less expensive than permanent life insurance policies.

- Universal life insurance: Universal life insurance policies offer a combination of permanent life insurance and investment features.

Listicle of Non-Par Insurance

Here is a listicle of some of the key features of non-par insurance:

- Fixed premiums

- Guaranteed death benefit

- Do not participate in the profits of the insurance company

- Can be used for a variety of financial goals

- Are a good option for people who want affordable and flexible life insurance coverage

Frequently Asked Questions

Q: What is the difference between participating and non-participating life insurance?

A: Participating life insurance policies participate in the profits of the insurance company, while non-participating policies do not. This means that policyholders of participating policies may receive dividends or other payments from the insurance company, while policyholders of non-participating policies will not.

Q: Are non-participating life insurance policies a good investment?

A: Non-participating life insurance policies are not considered to be investments. They are designed to provide life insurance coverage, and any cash value that accumulates in the policy is not guaranteed.

Q: What are the benefits of non-participating life insurance?

A: Non-participating life insurance policies have a number of benefits, including fixed premiums, guaranteed death benefits, and the ability to be used for a variety of financial goals.

Q: Are there any disadvantages to non-participating life insurance?

A: The main disadvantage of non-participating life insurance is that policyholders do not participate in the profits of the insurance company. This means that they will not receive dividends or other payments from the insurance company.

Conclusion of Understanding Non-Par: A Guide To Its Meaning And Usage In Insurance

Non-par insurance is an affordable and flexible option for permanent life insurance. It can provide peace of mind knowing that your loved ones will be financially protected if something happens to you. If you’re considering purchasing life insurance, be sure to speak with a qualified insurance professional to learn more about non-par insurance and other options.